March 2025 Market Commentary

Market Update and Economic Developments

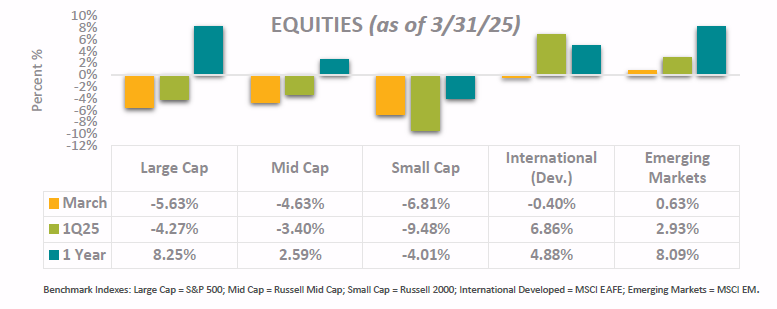

• Equities continued their downward march over the past month, with U.S. large cap stocks ending the month with a 5.63% loss. During March, the S&P 500 briefly entered “correction territory,” as the index fell 10% from its recent peak. Part of this decline can be attributed to the index’s high concentration in seven tech and AI stocks (collectively referred to as the “Mag 7”). Although these companies led the way during the S&P’s 20%+ back-to-back gains, they have also suffered more than other companies from recent economic uncertainty. The S&P 500 ex-Mag 7 is slightly up for the year, while the Mag 7 collectively are down almost 15% in 2025.

• The gap between international and U.S. markets continues to widen, with international stocks outperforming domestic large cap stocks by over 11% in the first quarter. This disparity underscores the benefits of holding a diversified portfolio; a meaningful allocation to international stocks can help portfolios mitigate U.S. market volatility while retaining equity exposure.

• The uncertainty in the scale and timing of tariffs has made it difficult for both foreign and domestic companies to make plans for the future. Auto tariffs were postponed just a day after they were scheduled to become active, and it is unclear under what circumstances the tariffs announced on April 2nd will remain in force. Such ambiguous expectations for foreign policy have forced many companies to take more defensive stances in their plans for growth.

Fixed Income Market Update and Other Assets

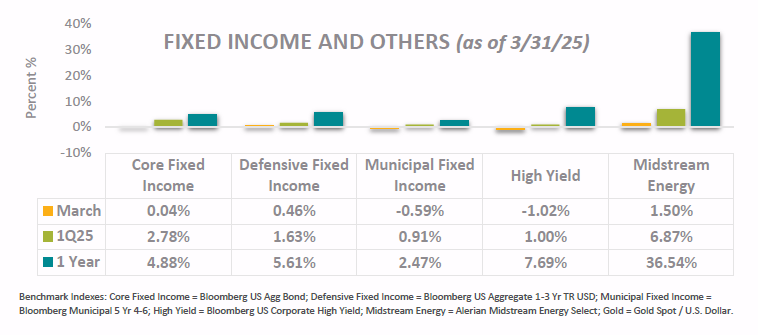

• Stubborn inflation and a murky outlook for the economy have limited the Federal Reserve’s ability to adjust monetary policy. At its March meeting, the Federal Open Market Committee (FOMC) left interest rates unchanged and maintained their forecasts for the next three years. The median FOMC member still expects two rate cuts in 2025, another two in 2026, and one in 2027.

• Core fixed income managed to stay just positive in March, with the Bloomberg U.S. Aggregate Index returning 0.04% for the month and 2.78% for the year. A diversified portfolio of stocks and bonds has proven its ability to weather the uncertainty of the last three months, with a balanced portfolio of 60% stocks and 40% bonds posting a decline of less than 1% year-to-date.

• Energy did well in March, continuing to generate modest gains amidst a tumultuous market. In public markets, the energy subsector of the S&P 500 returned 3.9% in March, making it one of the few subsectors that has been consistently positive in 2025.

Mission’s market and investment commentaries reflect the analysis, interpretation, and economic views and opinions of our investment team. They are not intended to provide investment advice for any individual situation. Please contact us if we can provide insight and advice for your specific needs.