July 2025 Market Commentary

Market Update and Economic Developments

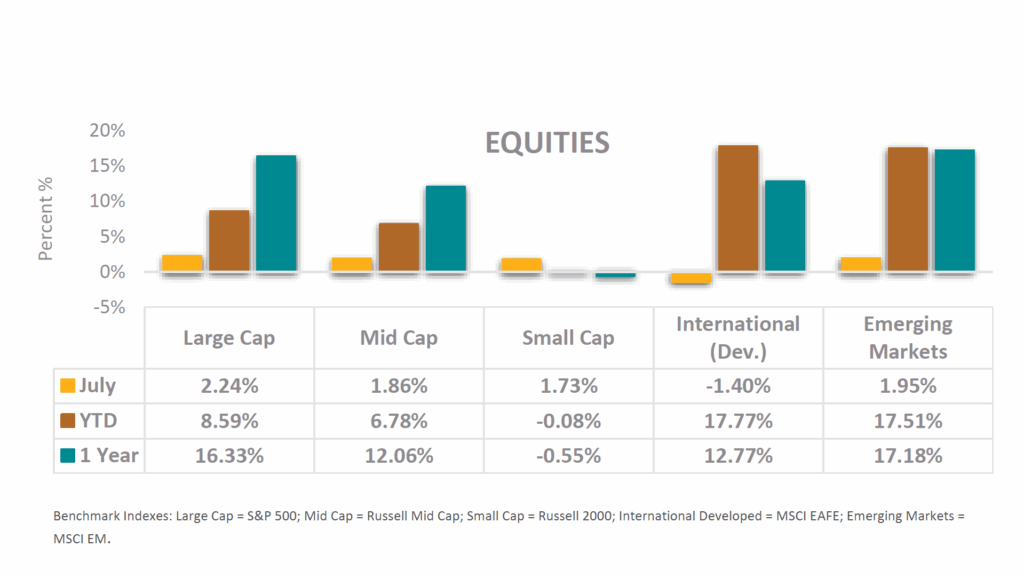

• U.S. equities extended their rally in July, with the S&P 500 rising 2.24%. AI enthusiasm continues to drive markets, with tech and communication service companies reporting strong earnings. Small cap stocks have remained nearly flat for the year, signaling cautious confidence in the broader U.S. economy. Overall equity performance has been strong in 2025 despite periods of elevated volatility.

• International trade agreements reduced uncertainty but still weighed on international stocks, which fell 1.40% in July. The U.S./EU deal introduced a 15% tariff on European exports, while the U.S./Japan agreement included a $550 billion investment commitment and a reciprocal 15% tariff. Japan also agreed to open its markets to more U.S. goods, including autos and agriculture. These moves helped stabilize global supply chains and support sentiment.

• In addition to weaker international trade amidst negotiations, emerging markets are currently experiencing a manufacturing slowdown. The Emerging Market PMI Output Index declined from 51.9 in April to 50.9 in May, marking the first time in eight months in which developed economies outpaced the growth of emerging economies. This is likely a result of a fall in production as U.S. tariffs and regulatory uncertainty affected the goods producing sector.

Fixed Income Market Update

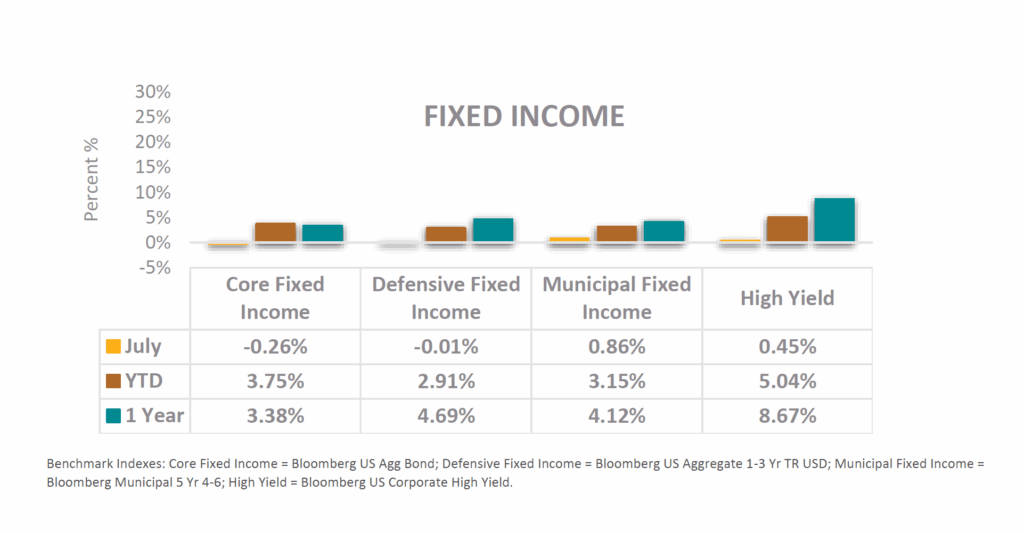

• The Fed held interest rates steady at 4.25%–4.50%, but markets expect 1-2 cuts by year end. At its July meeting, the FOMC acknowledged progress in bringing inflation back to its target of 2.5%. On August 1st, the Labor Department reported payrolls grew by just 73,000 last month, well below forecasts for about 100,000. It also revised estimates for May and June, with a cut of 258,000.

• Core fixed income declined in July, but returns have been strong YTD. High starting yields continue to be a tailwind for fixed income investors. Additionally, fixed income continues to be a source of income and diversification for investors.

• The One Big Beautiful Bill Act (OBBBA) introduced tax reforms with broad implications for investors. It made key provisions permanent for the Tax Cuts and Jobs Act, including lower tax rates, 100% bonus depreciation, and expanded pass through deductions. The bill preserved the 20% Qualified Business Income (QBI) deduction, benefiting small business owners, and raised the estate tax exemption to $15 million per person. It also enhanced Qualified Small Business Stock (QSBS) benefits and expanded Opportunity Zone designations.

Mission’s market and investment commentaries reflect the analysis, interpretation, and economic views and opinions of our investment team. They are not intended to provide investment advice for any individual situation. Please contact us if we can provide insight and advice for your specific needs.