February 2025 Market Commentary

Market Update and Economic Developments

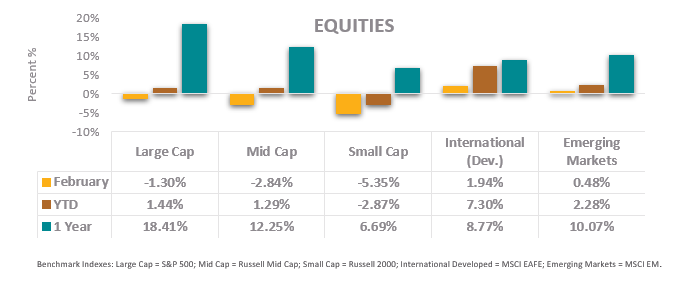

• International stocks, as measured by the MSCI EAFE, were up 1.94% in February and outperformed large US company stocks by 3.24% for the month, continuing strong relative performance year-to-date. German, United Kingdom, and French stocks led performance while Japan lagged developed international markets. This recent strength of developed international stocks defied the economic and geopolitical headwinds of potential tariffs being imposed by the United States.

• The S&P 500 was down 1.3% in February. Within the S&P 500, consumer discretionary and communication services lagged performance with declines in February of -6.3% and -9.4% respectively. Tesla’s (NYSE: TSLA) -27.58% decline for the month dragged consumer discretionary down, while Alphabet Class A’s (NYSE: GOOG) -16.23% decline brought down the communication services sector.

• Volatility increased slightly throughout February but remains well below levels seen during COVID-19 and the bear market of 2022. The rise in volatility came as fears over the implications of tariffs rippled through the markets. While one may be able to argue that tariffs are pro-American, the interconnectedness of the global economy prevents us from making such a clean conclusion, as data from Apollo indicates that 41% of revenue of S&P 500 companies comes from abroad.

Fixed Income Market Update and Other Assets

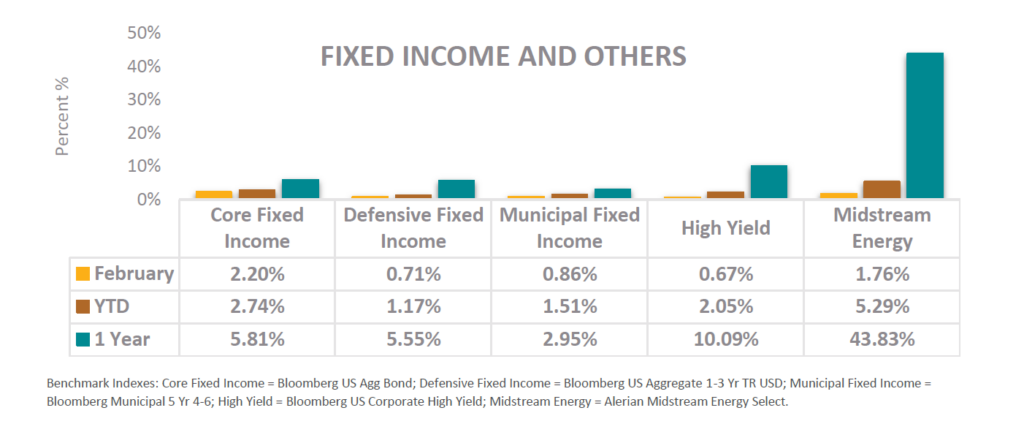

• The yield on the 10-year treasury declined to 4.20% at month-end after starting February at 4.54%. The Federal Open Market Committee did not hold a February meeting, and the federal funds target rate range has not changed since November. According to the CME Group FedWatch tool, markets are anticipating no rate cuts at the Fed’s March meeting yet still anticipate more cuts before year end.

• Overall inflation grew at an annualized rate of 3.3% according to the February report. While inflation has trended in the right direction for the past two years, it still remains elevated above the Fed’s 2% target.

• Core fixed income, as measured by the Bloomberg US Aggregate Bond Index, posted a return of 2.20% in February, with trailing 1-year performance of 5.81%. February’s performance in core fixed income was an improvement from January’s 0.51% rise. Historical core fixed income performance amidst a Federal Reserve interest rate cutting cycle and the starting point of yields warrants optimism for the forward outlook of fixed income

Mission’s market and investment commentaries reflect the analysis, interpretation, and economic views and opinions of our investment team. They are not intended to provide investment advice for any individual situation. Please contact us if we can provide insight and advice for your specific needs.