January 2025 Market Commentary

Market Update and Economic Developments

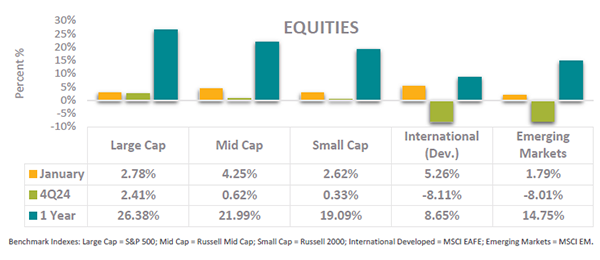

• Markets ended a bumpy month higher, with commodities, bonds and global equities notching gains despite uncertainty in international trade, interest rates, and the future of AI. Freshly inaugurated, President Trump wasted no time rolling out dozens of executive orders and policies to implement his campaign promises, with markets patiently waiting to see how the new administration’s threatened tariffs and other policies will affect the economy going forward.

• Chinese AI startup DeepSeek unveiled the large language model “DeepSeek R1,” which claimed to be 95% less energy intensive and costly compared to industry pioneers such as Chat GPT4. The news caused a panic in tech stocks, resulting in a $969 billion dollar sell-off in U.S. markets, with Nvidia falling $596 billion in value. This claim, should it be accurate, is expected to revolutionize the AI world and change the way companies approach training and developing their large language models.

• The Eaton and Palisades fires, which devasted large swaths of Los Angeles, have been fully contained nearly a full month after beginning on January 7th. Residents now must grapple with the daunting task of rebuilding, with estimates of the total economic loss ballooning to $250 billion dollars, making it one of the costliest natural disasters in U.S. history. Insurance companies are estimated to be on the hook for only $50 billion in payouts, leaving CA officials scrambling to find a solution to help residents clear toxic refuse and ultimately persevere through the tragedy.

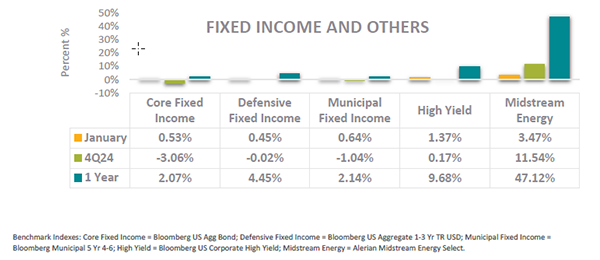

Fixed Income Market Update and Other Assets

• The yield on the U.S. 10-year note declined approximately 12 basis points to 4.5% as volatility measured by the Cboe Volatility Index (VIX) spiked to 15.35. U.S. bond investors are gearing up for the uncertainty of Trump policies and reduced expectations of rate cuts by continuing to avoid longer-duration bonds, effectively waiting to see how markets shake out.

• The Eurozone experienced no growth in the final quarter of 2024, largely due to high energy costs, high savings rates and weak manufacturing. Eurozone inflation edged higher in January with consumer prices rising 2.5% compared to this time last year. The European Central Bank cut interest rates to 2.75% with more cuts likely to come to jumpstart the Eurozone’s struggling economy at the same time as the U.S. decided to hold rates steady.

• Gold futures ended January with a stark rebound from a post-election slip, ending the month at $2,813 a troy ounce. The precious metal rose 7% in January, marking the biggest monthly gain in dollar terms since August 2011. The uptick arises from a flight to safety as investors continue to fear tariff repercussions and look for ways to hedge volatility.

Mission’s market and investment commentaries reflect the analysis, interpretation, and economic views and opinions of our investment team. They are not intended to provide investment advice for any individual situation. Please contact us if we can provide insight and advice for your specific needs.