June 2025 Market Commentary

Market Update and Economic Developments

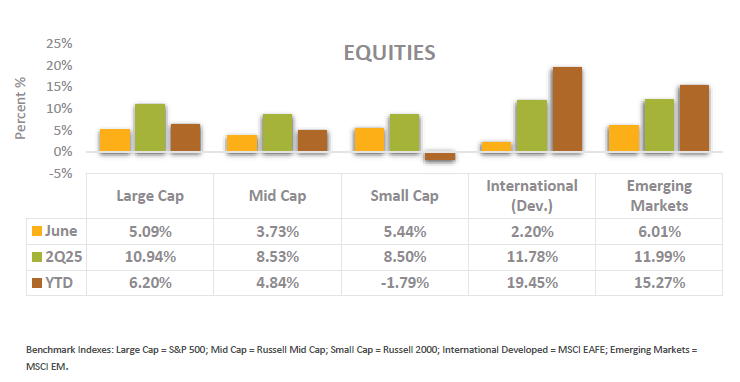

• U.S. equities ended their best quarter since 2013, with the S&P 500 Index reaching a new all-time high and notching a 5% gain in June and nearly an 11% gain for 2Q-2025. Stocks of smaller U.S. companies are still negative year-to-date, but large and mid-size public businesses have recouped all the losses that they suffered in April’s drawdown.

• Tariffs on foreign goods have settled at an average effective rate of ~15% as of the end of June. Although amounting to much less than the nearly 30% effective tariff rate announced in early April, the current effective tariff rate still far outstrips the sub 5% rate that the U.S. has employed since the 1970s. The excess inflation that tariffs were expected to produce has yet to materialize in the Consumer Price Index, which rose by a mere 0.1% in the month of May, putting the annual inflation rate at 2.4%. Although this is lower than many economists expected, it may signify a calm before the storm as inventory stock piling and paused manufacturing likely dampened the initial impact of tariffs.

• International stocks maintained strong performance throughout the second quarter, ending June with an impressive 19.5% gain year-to-date. Despite the wide gap in performance between domestic and international stocks, valuations outside of the U.S. remain attractive on a relative basis. The P/E ratio of Eurozone stocks is still relatively close to its 20-year average at 14.3x, while U.S. stock prices are still more than 21x earnings, which is significantly above their 20-year average.

Fixed Income Market Update and Other Assets

• In June, the Federal Open Market Committee unanimously voted to maintain the current interest rate range of 4.25% – 4.50%. Chair Jerome Powell continued to counsel a “wait and see” approach, reiterating that the effects of tariffs have not been fully realized. The nineteen members of the committee are nearly evenly split on their expectations for rate cuts this year: nine members expected to see just one rate cut, while the remaining ten members predicted two or three cuts.

• Domestic manufacturing compressed for the fourth straight month in June, as measured by the Institute for Supply Management’s manufacturing index, which measures U.S. factory activity. An index that measures order backlogs has contracted for a record 33 straight months, likely due to a reticence to make manufacturing commitments in the midst of economic uncertainty. Since factory activity is generally considered a leading indicator of economic health, these statistics may foreshadow the negative future impacts of tariffs on the economy.

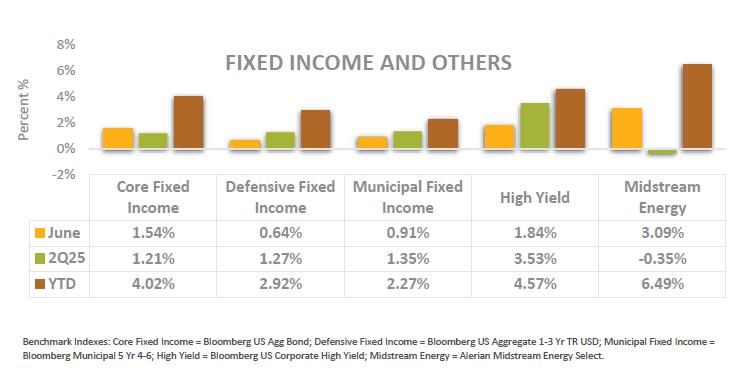

• Core fixed income posted a return of 1.54% in June, with the Bloomberg U.S. Aggregate Bond Index reaching just above a 4% return for the year. The U.S. Dollar suffered its worst start to the year since 1973, losing 10.8% of its value in the last six months. The flight from the dollar can be attributed in part to tariffs, which threaten to slow economic growth, as well as to the 2025 tax bill. However, the U.S. Dollar Index (DXY) remains well above the lows it experienced in both 2020 and 2008, and if the federal reserve continues to practice a slower pace of rate cuts than other central banks, the dollar’s decline may be more limited.

Mission’s market and investment commentaries reflect the analysis, interpretation, and economic views and opinions of our investment team. They are not intended to provide investment advice for any individual situation. Please contact us if we can provide insight and advice for your specific needs.