May 2025 Market Commentary

Market Update and Economic Developments

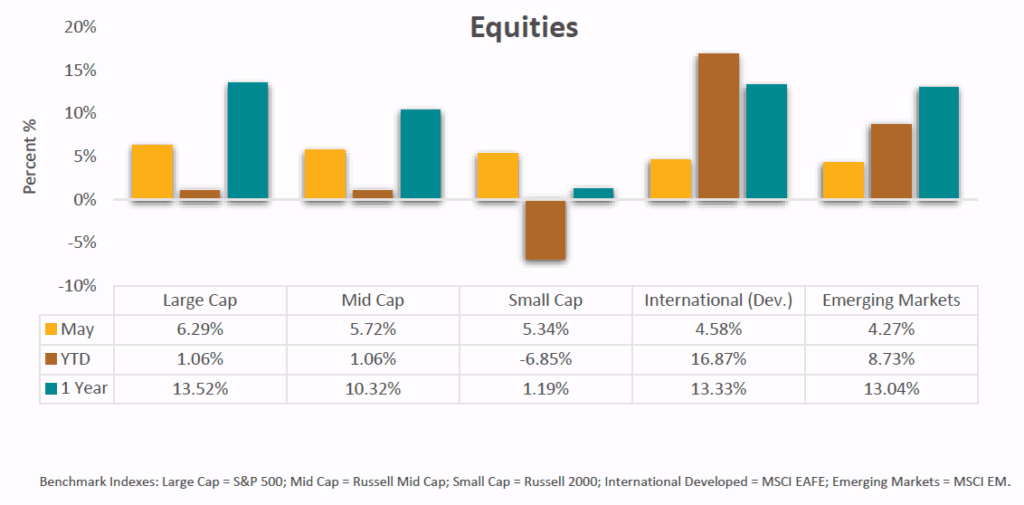

• The S&P 500 posted a 6.29% return in May, turning positive after a difficult start to the year amidst US policy uncertainty. Within the S&P 500, Technology and Communication Services led performance. Nvidia’s (NYSE: NVDA) 24.06% gain during May lifted tech following a strong earnings report. Nvidia’s earnings release indicated strong financial results and future guidance; year-over-year total revenue growth was 69% and data center revenue grew by 73% from a year prior.

• Market volatility was lower in May compared to April as discussions on tariffs subsided relative to the major announcements in April from President Trump. In May, various tariffs previously announced were paused or rolled back, including the United States and China agreeing to a 90-day reduction in tariffs, creating time for negotiation. In the upcoming months, tariffs will be a key driver of asset prices and Wall Street will be closely watching their impact on economic activity.

• Despite the headline of US GDP contracting at an annualized rate of -0.2%, economic growth was swayed by net export data. Total exports minus total imports are a subtraction when calculating GDP, and due to businesses trying to front-run the effective date of tariffs, imports spiked in the first quarter. Business investment remained strong in Q1, and consumer spending, despite slowing from prior quarters, was a positive contributor.

Fixed Income Market Update and Other Assets

• Rating agency Moody’s downgraded the United States debt from Aaa status to Aa1. Moody’s was the last major rating agency to downgrade the U.S. after downgrades from Standard & Poor’s and Fitch in 2011 and 2023, respectively. Globally, other Aa1 rated countries include Austria and Finland, while 11 countries including Canada, Germany, and Australia remain Aaa rated. In reaction to the downgrade, the yield on the 10-year treasury climbed to 4.39% at month-end after starting May at 4.17%.

• At their May meeting, the Federal Open Market Committee maintained the current interest rate target range of 4.25% – 4.50%, citing strong underlying economic activity despite the recent GDP contraction that primarily resulted from net exports. From a balance sheet standpoint, the assets on the Federal Reserve’s balance sheet continue to decline as they maintained their stance of tightening financial conditions.

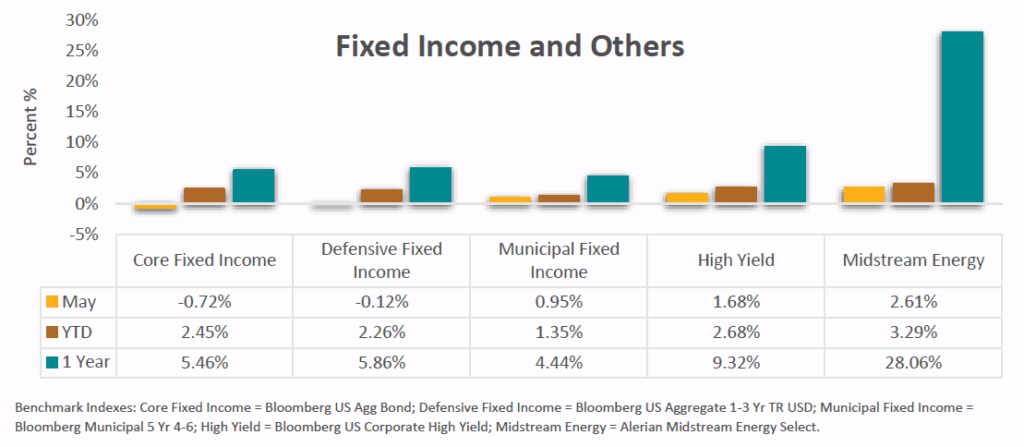

• Core fixed income, as measured by the Bloomberg US Aggregate Bond Index, posted a decline of -0.72% in May, with trailing 1-year performance of 5.46%. Core Fixed Income’s decline primarily came as a result of the slight increase in rates. Despite the decline, Core Fixed Income has played its role well as a ballast to volatility. A diversified portfolio of 35% Large Cap Stocks, 25% International Developed Stocks, and 40% Core Fixed Income returned 5.57% year-to-date through the end of May, marking a period of strength for a diversified portfolio despite challenging volatility.

Mission’s market and investment commentaries reflect the analysis, interpretation, and economic views and opinions of our investment team. They are not intended to provide investment advice for any individual situation. Please contact us if we can provide insight and advice for your specific needs.