2023 3rd Quarter Market Commentary

Bull Market or Bear?

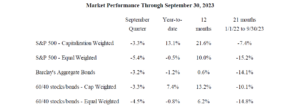

The markets have just concluded a weak quarter, a mixed year-to-date, a mostly strong trailing 12 months, and a significantly negative period overall since the end of 2021. The worst fixed-income decline in U.S. history has been unfolding for more than three years. In the minds of many, however, it is an open question as to whether equities are in a bull or bear market.

Market commentators have a variety of definitions of bull and bear markets. Most on television seem content to accept a 20% move in either direction for the Dow Jones Industrial Average or the S&P 500 as sufficient evidence of the bull or bear gaining control. Such a simplistic approach is a relatively recent construct; one I can’t remember having heard defined until some time in the 1990s. Prior to that, a significant market price move had to take place over a somewhat extended period of time before commentators would describe it as a new bull or bear market. Even that added time element sometimes failed to provide adequate clarity. What if just a few stocks or a single industry precipitated the major up or down price move with the vast bulk of stocks not following? Frankly, several factors are far more important than a “bull” or “bear” designation in providing a background for prudent investment decision-making. The markets that we have experienced over the past few years make that case fairly conclusively. Let me examine some of the nuances that may help to inform investment decisions in the quarters ahead.

First, let’s examine what has already happened, and how some of the most commonly used equity and fixed-income indexes have failed to provide clear pictures of how most investor portfolios have performed.

As the market performance summary above displays clearly, there is a marked difference between the performance of the capitalization-weighted S&P 500, where the biggest companies have a disproportionately heavy weight in the index, and the equal-weighted index, where every stock has the same weight, regardless of company size. That difference is especially pronounced so far in 2023. Because of the outstanding performance of the Magnificent Seven – Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla – giants all, the S&P 500 was up by 13.1% in this year’s first three quarters. If the performance of each company in the S&P 500 were given equal weight, the index would have been down by 0.54%, with 227 stocks up and 271 down over the same nine month period.

So have we been in a bull market that began with the powerful October 2022 to July 2023 rally and has merely been interrupted by the third quarter and early fourth quarter decline? Or have we been in a bear market since the end of 2021 with the S&P 500 still down by 7.4% at the end of this year’s third quarter, despite the powerful interruption fueled by a handful of giant tech stocks? Even an index comprised solely of the Magnificent Seven would be down since the end of 2021. The only period of profit would have been during the October to July rally and then only in a limited number of stocks.

The fixed income market, which has normally offset at least a portion of history’s more significant equity declines, did the opposite in the current instance. In fact, since the end of 2021, the Barclay’s Aggregate Bond Index was down almost twice as much as the S&P 500. Having foreseen the likelihood of rising interest rates over the last few years, we have structured portfolios to minimize risk and maximize safe income. We have kept equity allocations at client-mandated minimums, and we have laddered U.S. Treasury securities in a maturity range out to about two years. Because the inverted yield curve has rewarded keeping duration short, we have produced positive returns through the worst bond market decline in U.S. history. Client fixed income allocations now have yields-to-maturity of more than 5%.

Where do we go from here?

Obviously, investors face a barrage of critical variables – war or peace in multiple locations, growth or recession globally and domestically, Fed tightening or easing, plus the ever-present questions of market valuations and degrees of investor bullishness.

The outcome of military conflicts currently looks unpredictable. Because the outbreak of the conflicts has not significantly damaged markets, neither would favorable resolutions likely provoke meaningful relief rallies. On the other hand, dangerous widening of the fighting, especially with U.S. involvement, would likely raise investor concerns substantially.

The economy, of course, has a huge number of measurables that can meaningfully affect progress toward either growth or recession. The rapid rise in interest rates is the single most important economic factor affecting growth potential. While the levels of most interest rates are not appreciably different from very long-term averages, they are far above the levels of the past 10 and 20 years. That means that the cost of money to fund business growth is well above what businesses have grown accustomed to over the past two decades. While there is a significant difference of opinion among economists about whether a recession is coming, there are no reputable forecasts of even average economic growth levels for at least the next few years. At best, we face a low growth environment.

Anecdotally, a recent New York Times story pointed to corporate defaults running at the fastest rate in over a decade. Federal Reserve data have shown credit card delinquency rates growing quarter by quarter. A recent New York Fed survey maintained that one out of eight American households will not be able to make their minimum debt payment in the next three months. In the past two weeks, the biggest US banks have, for the most part, announced better than expected third quarter earnings, while simultaneously predicting upcoming economic trouble. None forecasted upcoming economic strength.

Not much has changed in recent weeks with regard to the Federal Reserve’s likely actions. A few Fed governors have expressed their willingness to pause further rate increases in order to evaluate the effect of their already aggressive tightening policy. At the same time, they have indicated no intention to begin an easing process for several quarters at the earliest. A few governors still believe at least one more rate increase to be appropriate. It looks unlikely that the Fed will soon provide more economic or market support.

As I write this commentary three weeks into the fourth quarter, the price declines early in the quarter have reduced the S&P 500 price/earnings ratio on a Generally Accepted Accounting Principles (GAAP) basis to 22.9. That’s down from the recent extraordinary 25 level but still more than 50% above the long-term average level of about 15. While extremely over- or under-valued readings do not necessarily forecast what is immediately ahead in all instances, more than a century of data show conclusively that, on average, market performance measured from levels of over-valuations show below average subsequent returns over all time periods. The opposite is also true from levels of under-valuation. The biggest market gains and losses tend to follow the extremes of under- or over-valuation respectively. It is safer and typically more productive to be swimming with the tide.

Notwithstanding the list of dangerous geopolitical, military and economic conditions, not everybody is bearish. U.S. market indexes are not far off the all-time highs of less than two years ago. Equity markets also go up more often than they go down. And all you have to do is tune into financial TV stations to hear the majority of interviewees explaining their bullish forecasts. Recognize that TV stations and financial publications have many more viewers and readers when markets are strong and the outlook is bullish, and are thus incentivized to provide mostly bullish content. And most of the people with bullish outlooks come primarily from investment banks, portfolio managers and brokers, all of which have a bias toward bullishness because it’s better for business. Nobody wants to antagonize corporate clients or potential clients.

Bearish outlooks are more often voiced by people from independent firms not dependent on broad institutional clienteles. Ray Dalio has been co-chief investment officer of the world’s largest hedge fund, Bridgewater Associates, since 1985. He has never shied away from controversial outlooks. A few weeks ago in a CNBC interview, Dalio said: “We’re going to have a debt crisis in this country…. I think you’re going to get a meaningful slowing of the economy.” Debt levels have ballooned in recent years to more than $33 trillion. Dalio believes that economic growth could fall to zero, “give or take 1-2%.”

Just over a week ago, Jaime Dimon, CEO of J.P. Morgan Chase, the world’s largest bank, another corporate titan not afraid to speak bluntly, said: “This may be the most dangerous time the world has seen in decades.” He pointed to several contributing factors: the war in Ukraine; Hamas attacks in Israel, which “may have far-reaching impacts on energy and food markets, global trade, and geopolitical relationships”; a burgeoning national debt and “the largest peacetime fiscal deficits ever”, raising the risks that inflation and interest rates remain high; and quantitative tightening, which will continue to reduce liquidity. Because of these factors, he warns–contrary to majority thinking–that interest rates could rise significantly.

Investors are still faced with the conditions and conflicting potentials that we have discussed in the last few commentaries. As explained earlier, markets are trading at valuations not far from all-time highs. Markets rarely trade above current levels of valuation, but there is no absolute prohibition that bullish enthusiasm can’t rise again to an even more rarified altitude. With so many significant variables pointing in a negative direction, however, investors should evaluate carefully their willingness and ability to assume risk in seeking investment reward. With no reputable forecasts of even average domestic or global economic growth over the next several years that could justify today’s extreme over-valuations, the potential for more multi-year equity profit is limited. But that possibility has existed over a meaningful portion of the past decade and a half during which the Federal Reserve and other major central banks have provided the backstop to prevent any significant decline in securities markets. Until the past two years, that central bank support has convinced investors that staying committed to substantial equity allocations was the prudent investment policy. Now that virtually all central banks have abandoned their loose money policies in order to fight inflation, investors may be facing a markedly different investment environment for years to come. With risk-free short-term U.S. Treasury returns currently over 5%, there is real competition for the siren call of the equity markets. Our preference is to utilize the risk-free yields above 5% as much as possible while searching for attractively valued equities with the potential for earnings growth even in a slow growth or recessionary environment.

By Thomas J. Feeney, Chief Investment Officer

Mission’s market and investment commentaries reflect the analysis, interpretation and economic views and opinions of our investment team. They are not intended to provide investment advice for any individual situation. Please contact us if we can provide insight and advice for your specific needs.