2024 2nd Quarter Market Commentary

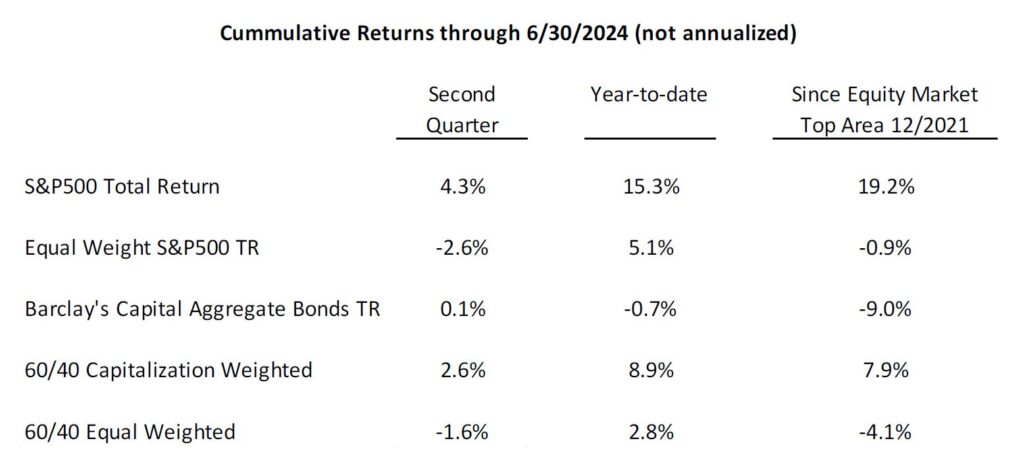

The exciting narrative about artificial intelligence has dominated equity market news in recent years. AI’s effect, however, has produced positive results in just a narrow segment of the stock market. The market performance results above testify to the outsized influence that the Magnificent Seven mega-tech stocks (Apple, Amazon, Alphabet, Meta Platforms, Microsoft, Nvidia and Tesla) impose on the S&P500, a capitalization-weighted index. These seven giant corporations currently comprise more than 30% of the value of the 500 stocks that make up the index. Their recent strength is seen in the table vividly when the S&P500 performance is compared to the performance of the entire 500 companies, with each accorded equal weight. If an investor held equal dollar weights of all 500 stocks at year-end 2021, the portfolio would have been worth slightly less at the end of this year’s second quarter–even including all dividends paid.

While the two-and-a-half-year performance of the Magnificent Seven has been outstanding, their path has not been entirely smooth. From their respective tops in late- 2021 or early-2022, the average decline to their individual troughs roughly a year later was 56%. In fact, the biggest star in the AI universe, Nvidia, declined by 68% from late- 2021 to late-2022 before exploding upward to its recent level. Enthusiasm about the AI story rescued these few stocks and, because of their size, the broader market as well since late-2022

Investors inevitably get excited about high tech stocks when they rally. They make the headlines. Technology has always been the industry of the future, but broad investments in high tech stocks, despite intermittent giant rallies, have not outperformed long-term market averages. I started in the investment business in 1969, and have observed a 50% or greater tech industry decline starting in each of the subsequent six decades. Many former highfliers went out of business along the way. Great fortunes have been built with concentration in a relatively few ultimate winners, but successfully identifying them early is a less than predictable exercise.

Today’s biggest and most popular tech giant is not necessarily tomorrow’s best investment. The most dramatic example of that point is Cisco. Still a highly respected technology leader, in 2000 Cisco was the largest company in the world by market capitalization, the king of the internet in the dot.com era. In today’s prices, Cisco reached $82 per share. As the economic cycle turned down, the dot.com bubble burst and Cisco’s price plummeted by 90%. The company is still selling more than 40% below its high of nearly a quarter century ago. That doesn’t mean that today’s tech giants won’t be leaders a decade or more from now, just that current research may not even recognize some of tomorrow’s potential negative factors.

Ned Davis Research does thousands of valuable economic and market-related studies. One that demonstrates the historical basis for favoring deep discount value equities compares the long-term performance of low versus high price-to-earnings (PE) equities. Contrary to most investors’ beliefs, over the past century, the highest performance has come from stocks that fell in the lowest quintile of PE multiples. Each higher PE quintile had lower long-term performance, with the highest PE stocks having the weakest long-term results. The leading high-tech stocks typically reside in the highest PE quintile. While the leaders are often spectacular when they are rallying, when all the advances and declines are computed, the whole group tends to underperform their more pedestrian and less publicized brethren.

Over our most recent five Quarterly Commentaries, I have attempted to outline a variety of major factors that could lead alternately to either strong or weak market outcomes. In our April 2023 commentary (1Q 2023), I quoted Warren Buffett’s counsel that “in the short run the stock market is a voting machine, while in the long run, it’s a weighing machine.” Voters’ decisions are often predicated on sentiment – how do I feel given all that I’ve seen and heard, especially recently? In what direction do I believe the market is about to go? Weighing, on the other hand, involves the evaluation of factors leading to economic growth or decline or to corporate profits or losses. Weighing tends to push aside the more emotional aspects of decision making. Voting has clearly dominated in the past two years as equity markets have continued to advance despite the fact that economic and corporate profit growth have been below average with interest rates rising strongly.

In October 2023 (3Q 2023), I pointed out that there was no prohibitive limit to voter bullishness despite then current valuation levels not far from all-time highs. In the January 2024 commentary (4Q 2023), I spelled out the differences between fundamental and technical factors and how each was being evaluated by investors at the beginning of this year.

Technical strength or weakness is typically a reflection of investors’ voting attitudes. By contrast, weighing involves a comprehensive analysis of fundamental factors. History has demonstrated that the single most important determinant of future investment profits is the price paid for such factors as sales, earnings, dividends, cash flow and book value. In that January 2024 Commentary, I also spelled out in some detail how the S&P500 has performed after reaching some of history’s most extreme levels of valuation. After all eight prior valuation extremes over the past 92 years, the stock market declined aggressively by an average of 40%. Even more importantly, the declines took prices back to levels first reached nine years earlier. And the declines had long-lasting effects. It took an average of 9.8 years for prices to get back to the highs that marked the beginning of each decline.

Even more concerning from a fundamental weighing point of view is that the overvaluation levels at the end of this year’s second quarter were far higher than the average of all eight prior valuation peaks and below only one of those eight peaks – the 2000 dot.com mania, which preceded two bear markets that left the S&P500 more than 50% lower nine years later.

Despite a pullback in recent weeks, especially in the Magnificent Seven, most technical measures remain positive. Well known and respected technical analysis firm Lowry Research made the point in late-July that expanding breadth and most intermediate-term technical conditions point to a reasonable probability of still higher equity prices. Valuation and other fundamental factors, however, are far less attractive. Forecasts for meager domestic and global economic growth for the next few years don’t seem compatible with most Wall Street forecasts for double digit corporate earnings growth for this year and next.

That leaves us offering the same counsel I provided in last quarter’s commentary: “With investor enthusiasm and confidence in Fed assistance still strong, positive technical conditions could push prices to new record highs. At the same time, even if prices do rise further, it is important to recognize that the modern U.S. market has never before failed to decline significantly from even less overvalued market levels.”

While we are always looking for common stocks with growing earnings selling at attractive valuations relative to the market and to that company’s own valuation history, they are today very few and far between. As a result, we continue to maintain a cautious approach, which has provided our clients with performance over the past two and a half years better than all indexes at the top of this commentary except the all-equity S&P500 which has been dominated by the Magnificent Seven.

With many variables facing the markets in the next couple of years, we are eager to determine with clients their preferred balance between asset protection with income and a quest for capital growth in a high-risk market environment.

On a separate note, we are happy to announce that we are bringing back our investment conference this November. The pandemic interrupted a series of conferences which Mission’s predecessor firms began in 1985. We have always enjoyed the opportunity to share our investment outlook, to meet with you and to answer your questions in a relaxed and enjoyable social setting. More information will be coming as we get closer to the date.

Thomas J. Feeney

Chief Investment Officer

This market commentary is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors.