August 2025 Market Commentary

Market Update and Economic Developments

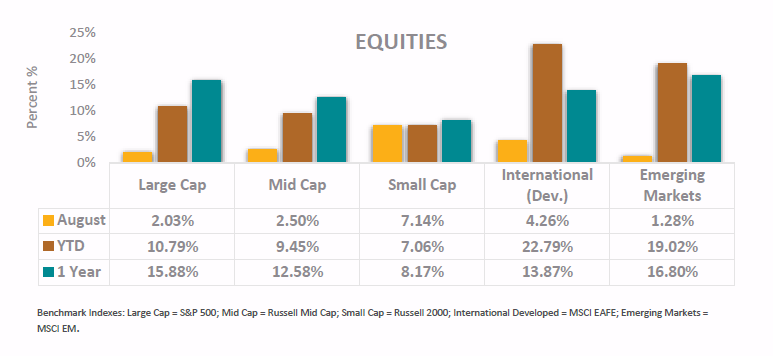

• The S&P 500 posted a 2.03% return in August, bringing the year-to-date return to 10.8%. Small cap stocks continue to exhibit higher volatility; despite their 7.1% gain in August, they continued to lag large cap stocks year-to-date due to their deeper drawdown in April. Within large cap stocks, Apple’s reported higher than expected sales and earnings in its 3rd quarter, as buyers hurried to buy before anticipated tariff related price increases. On the back of its strong earnings report, Apple rallied for a 11.9% return in August.

• Real GDP increased at an annual rate of 3.3% in the second quarter of 2025, above the 25-year trend of 2.1% but in line with average historical growth going back to 1930. The increase in real GDP in the second quarter stemmed from a decrease in imports, which are a subtraction in the calculation of GDP, and an increase in consumer spending.

• Job growth in the US has slowed over the past three months. With the revisions down to the US jobs reports from May and June, on a rolling 3-month basis the US economy has added the least amount of jobs in close to 15 years. The number of job openings for every unemployed person in the US has shrunk from 2 to 1 since 2022. Given that inflation has stabilized since peaking in 2022, Fed rhetoric has shifted towards ensuring labor market stability on signs of relative weakening despite otherwise strong employment.

Fixed Income Market Update

• The Federal Reserve Open Market Committee did not hold a vote on the target policy range of the Federal Funds Rate in August. Instead, Fed Chair Jerome Powell spoke at the Jackson Hole Economic Symposium where his comments seemed to open the door for interest rate cuts, potentially as soon as the upcoming meeting of the FOMC on September 17. At the end of August, the federal funds rate futures market indicated that investors were pricing in an 87.9% chance of a September rate cut of 25 basis points, up from just 39.8% at the close of July.

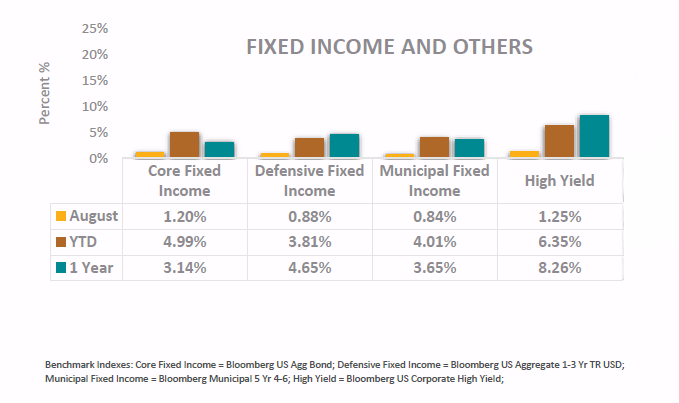

• The yield on the 10-year treasury remained flat throughout August, ending the month at around 4.2%. Over the last 5 years, the 10-year peaked at around 5% in the fall of 2023 and has been on a downward trend throughout 2025 where it started the year around 4.6%. Thanks to lower interest rate volatility through the summer, fixed income assets continue to plod along, with moderate performance year-to-date across the board.

• In the residential real estate sector, the Case-Shiller U.S. National Home Price Index is up 2.4% year-to-date and 1.9% year-over-year. For context, US home prices were posting double digit year-over-year growth for over 18 months from January 2021 through August 2022. New home construction continues to be muted due to the sharp increase in financing costs following the interest rate increases of 2022, with activity below the historical average going back to 1960.

Mission’s market and investment commentaries reflect the analysis, interpretation, and economic views and opinions of our investment team. They are not intended to provide investment advice for any individual situation. Please contact us if we can provide insight and advice for your specific needs.