Choosing The Best Trustee For The Job

You have what it takes to be the trustee of your trust. You are responsible and sensitive to the needs of your trust’s beneficiaries. You understand business and investments. You can easily manage your trust assets.

You assumed the role of trustee without much thought and it’s been an easy experience. Remember, however, that it might not be as easy for your successor trustee. While you are currently the best person for the job, what happens when you are no longer able to serve?

A trustee holds legal title to property for the benefit of another. A trustee also acts as a fiduciary, which means the trustee must exercise good faith in dealing with beneficiaries. A successor trustee steps in when the original trustee can no longer serve due to incapacity or death, or simply because the original trustee chooses to resign.

It’s a simple concept, but not a simple job. A trustee’s duties are varied and include:

Investment management: Trust assets must be invested according to the trust’s terms. The trustee should be familiar with the prudent investor rule and the concept of diversification.

Treating beneficiaries fairly: A trustee balances the needs of current and future beneficiaries when investing and distributing trust assets.

Loyalty: A trustee must avoid self-dealing. Generally, the trustee may not have a personal interest in any transaction involving trust property.

Reporting: The trustee files income tax returns and provides beneficiaries with regular reports of the trust’s financial condition.

Choosing a trustee is an essential part of every estate plan. Ask yourself these questions about your chosen trustee:

- Is the person or entity willing to assume the duties of a trustee?

- Are the beneficiaries of my trust best served by this person or entity?

Individuals as Trustees

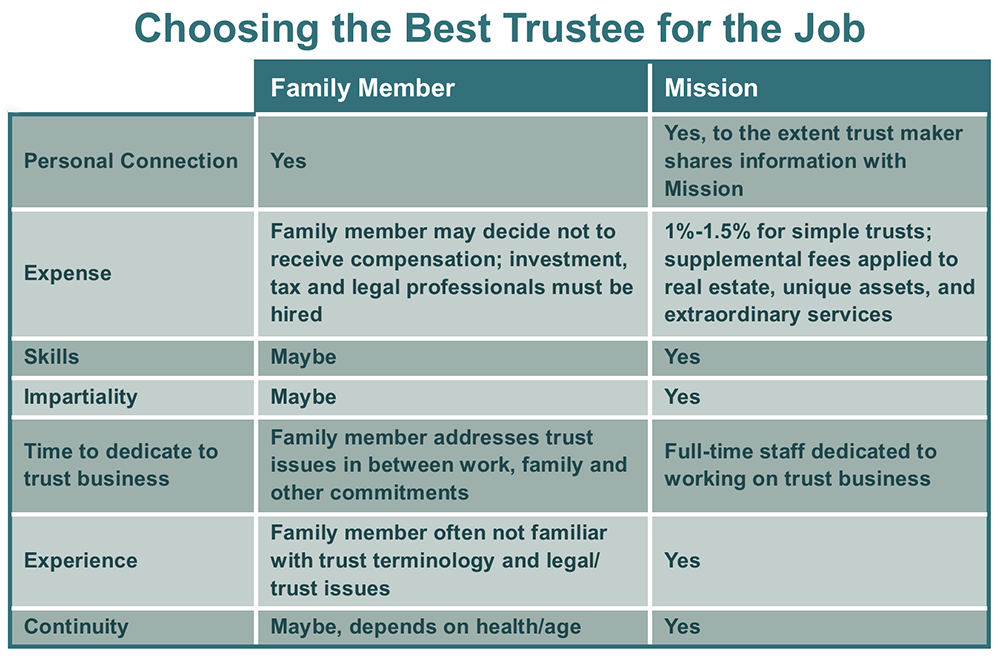

Many trust makers name a family member as successor trustee. Perhaps your trust is small and hiring outside professionals is too expensive. Or, you believe there is little possibility of conflict after you step down. In this case, a family member may be a good choice. Your family member knows you best and is concerned with administering your trust efficiently.

Don’t assume, however, that a family member is willing to act as trustee. Serving as trustee is time consuming and complicated, especially if you become incapacitated for an extended time. Ensure that the person you choose wishes to serve as trustee and understands what is involved.

Corporate Trustees

Trust companies and financial institutions, like Mission, serve as trustees. Corporate trustees provide objective alternatives to a family member. We are bonded and regulated by law.

Often, a family member lacks the skills outlined above and needs professional assistance from investment managers, accountants and attorneys. These professional services are typically included in a corporate trustee’s fees.

It is common for family members to face conflicts with relatives while serving as trustee. Since a corporate trustee is independent, it is more likely to make difficult decisions without causing family rifts.

Choosing the Right Trustee

If you are still on the fence, take time to make your decision. Consider whether your trustee has the time, experience and temperament to do the job right.

You have spent a lifetime building your wealth so that it will be there for you when you need it. At Mission, our goal is to protect those assets and ensure your best interests. Contact one of our trust officers to discuss your situation and how Mission can protect your legacy.

By Christina Noz, Vice President, Trust Administration