December 2025 Market Commentary

Market Update and Economic Developments

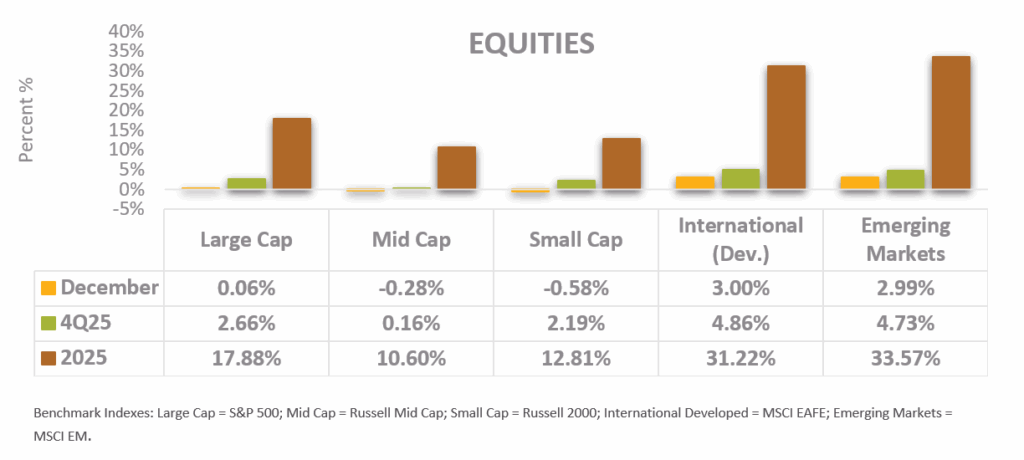

• The S&P 500 Index dipped slightly in mid-December but ended the month nearly flat, delivering an underwhelming end to 2025 when compared to the quarter’s 2.66% gain and the year’s 17.88% return. The proportion of that annual return attributable to Magnificent 7 performance has continued to decline in the second half of 2025, dipping below 50% for the first year since 2021. In addition to generating strong returns, the S&P 500 excluding Mag7 has begun to accelerate earnings growth, with J.P. Morgan estimating earnings grew by 9% in 2025 for the S&P 493, compared to growth of 4% in 2024 and -4% in 2023.

• International equities continued to outperform domestic stocks in December, with both developed countries and emerging markets notching about a 3% gain for the month. This concludes a year of 30%+ performance, rewarding investors who stayed diversified despite the past decade of U.S. dominance. Even with the stellar year, U.S. valuations still far exceed international valuations, with the S&P 500 recording prices at 22x earnings, while the Eurozone and emerging markets sit at 16x and 13x price-to-earnings (P/E) ratios, respectively. Prudent diversification remains essential for investors wishing to capitalize on opportunities across the globe.

• Ballooning equity valuations have led many investors to fear the irrational exuberance of the dot-com bubble is being replayed today with AI investment. While several characteristics of today’s markets are reminiscent of the early 2000s bubble, the P/E ratios of top companies are starkly different. In October, Goldman Sachs reported the median 24-month forward P/E ratio across the Magnificent 7 is 27x, which is roughly half of the equivalent valuation of the largest 7 companies during the dot-com era.

Fixed Income Market Update

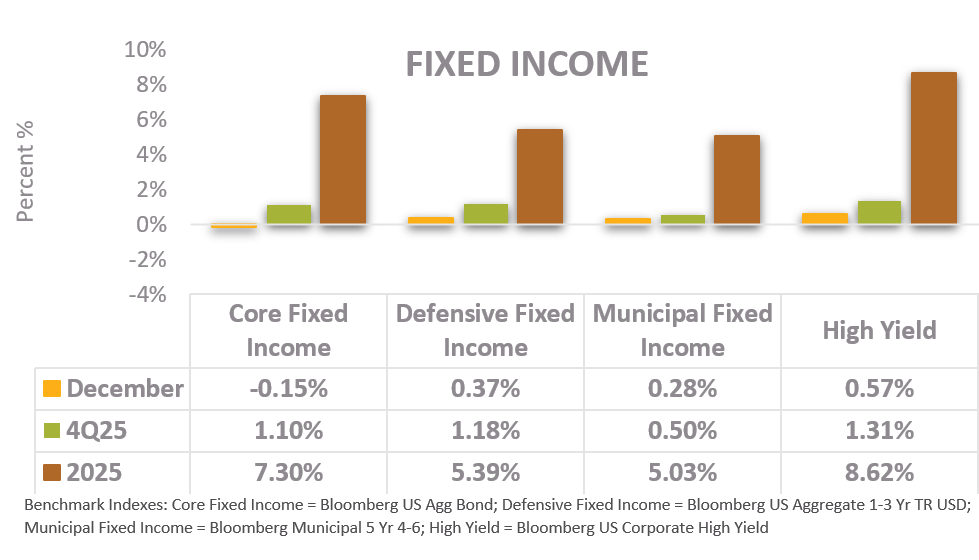

• Core fixed income fell slightly in December but still managed to reach 7.30% for the year, recording its best year since 2020. For investors willing to trade some credit quality for excess return, high yield bonds performed well, maintaining a positive return in December and outperforming the Bloomberg U.S. Aggregate index by 1.32 percentage points for the year. While this gain is meaningful, credit spreads remain tight relative to historical averages, meaning investors have not been as compensated to take on more credit risk as they have been in the past.

• Municipal debt gained 0.28% in December, ending the year at just over 5% (before adjusting for taxes). Municipals faced some headwinds in 2025, most notably an influx of supply as issuers exhausted COVID relief funds and made larger issuances than they have in recent years. However, municipal fundamentals remain robust, with pandemic-era support creating near-record levels of state and local reserves without significant increases in borrowings.

• At its last meeting of the year, the Federal Reserve made a third consecutive cut to the federal funds rate, bringing the target to 3.50% – 3.75%. The unemployment rate has risen steadily, standing at 4.6% as of November, and the consumer price index is still above the Federal Reserve’s target, at a year-over-year increase of 2.7% according to most recent data. In the December press release, Chair Jerome Powell remarked he expects the effects of tariffs on inflation to be relatively short-lived, while more persistent down-side risks to employment means the balance of risks has shifted. Looking ahead, the Federal Reserve’s Summary of Economic Projections shows the median committee member expects the Federal Funds rate to be 3.4% at the end of 2026 and 3.1% at the end of 2027, potentially signaling one cut in each of the next two years.

Mission’s market and investment commentaries reflect the analysis, interpretation, and economic views and opinions of our investment team. They are not intended to provide investment advice for any individual situation. Please contact us if we can provide insight and advice for your specific needs.