January 2026 Market Commentary

Market Update and Economic Developments

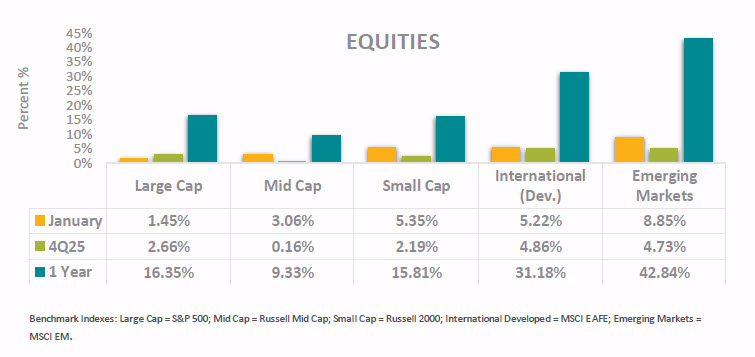

• Equity markets started 2026 with strong positive momentum, supported by a notable expansion in leadership across regions and market capitalizations. U.S. equities advanced in January with large cap stocks rising 1.45% while mid- and small-cap materially outpaced their larger peers, gaining 3.06% and 5.35%, respectively. Early month volatility weighed on large cap indexes as investors digested the Federal Reserve’s decision to pause rate cuts amid lingering inflation concerns tied to tariffs. Meanwhile, the Magnificent Seven stocks declined between 1.2% and4.5%. January’s gains reflected broad participation rather than dependence on a narrow group of mega cap stocks, marking a constructive evolution from the more concentrated return profile that characterized portions of 2025.

• International equities delivered strong returns during the month, supported by easing financial conditions and improving sentiment toward global growth. Developed international markets rose 5.22% in January, while emerging markets surged 8.85%, extending their strong performance from late 2025. Over the past year, emerging markets are up over 42%, and developed international stocks have gained over 31%, benefiting from attractive valuations, a weaker U.S. dollar backdrop, and renewed investor appetite for global diversification.

• Corporate earnings continue to support equities as Q4 reporting gets underway. With roughly one-third of S&P 500 companies having reported as of January 30th, 2026, 75% have beaten EPS estimates and 65% have exceeded revenue expectations, driving aggregate earnings 9.1% above estimates and lifting blended earnings growth to 11.9% year-over-year, on pace for a fifth consecutive quarter of double-digit annualized growth. Margins remain a standout, with the index on track for a record 13.2% net profit margin (FactSet), while revenue growth of 8.2%year-over-year marks the second strongest pace since mid-2022 and the 21st consecutive quarter of expansion.

Fixed Income Market Update

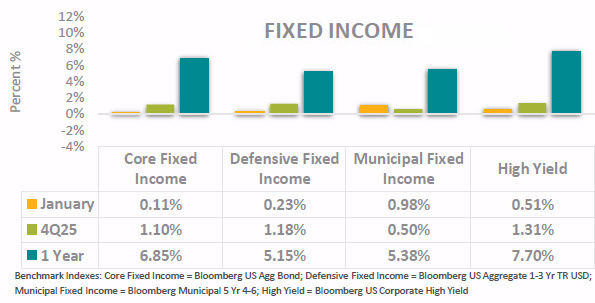

• Core fixed income posted modest gains in January, supported by stable rates and a constructive macro backdrop. The Bloomberg U.S. Aggregate Bond Index rose 0.11% for the month rebounding from its slight fall in December and is up 6.85% over the past year, benefiting from higher starting yields and steady income generation. For investors willing to assume additional credit risk, high yield bonds outperformed with a 0.51% gain in January and a 7.70% return over the past year.

• With the broader economic environment remaining relatively stable, the Federal Reserve held the federal funds rate unchanged at 3.50%–3.75% at its first meeting of 2026, balancing pockets of labor market softness against still‑elevated inflation. Policymakers pointed to recent stability in employment data and stronger economic momentum late last year, including 4.4% GDP growth in the third quarter as justification for a patient stance.

• Corporate bond issuance is accelerating as large technology companies increasingly turn to debt markets to fund AI-related capital spending, underscoring a structural shift in how these businesses finance growth (Bloomberg). Issuance activity in January was led by sizable deals from mega cap issuers such as IBM and AT&T, helping push U.S. high grade supply above $200billion for the month. While the technology, media, and telecommunications (TMT) sector has historically been most active in February and March, the scale and timing of recent issuance reflect a broader change. Many of the “Magnificent 7” are no longer capital light companies generating excess free cash flow but instead face an ongoing investment arms race that requires sustained spending to remain competitive. JPMorgan expects this dynamic to drive a record$400 billion in high grade TMT issuance in 2026. Despite this surge in supply, demand for high quality credit remains strong, with inflows into high grade bond funds helping keep spreads near multi decade lows. That said, rising leverage and elevated capital intensity suggest profit margins and return profiles for mega cap technology companies may be less favorable in the coming decade than in the last.

Mission’s market and investment commentaries reflect the analysis, interpretation, and economic views and opinions of our investment team. They are not intended to provide investment advice for any individual situation. Please contact us if we can provide insight and advice for your specific needs.