November 2025 Market Commentary

Market Update and Economic Developments

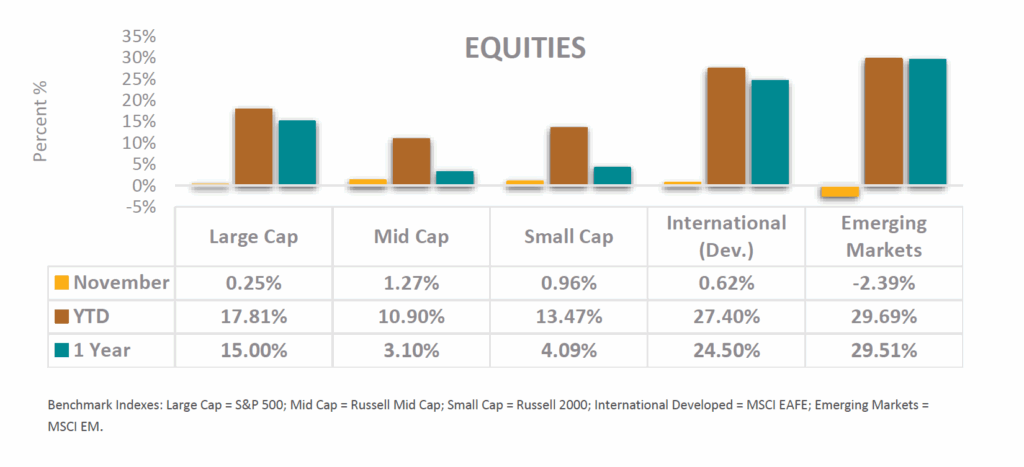

• The S&P 500 had a relatively quiet month in November, posting a meager 0.25% gain, bringing the YTD return to 17.81%. Investors are actively sorting through new developments in AI technology and who is leading the charge, creating dispersion between the winners and losers. Shares of Oracle declined by over 20% in November as investors responded negatively to increased debt issuance, erasing the >30% single day gain the stock had in September. On the positive side, shares of Google were up close to 14% in November, making this the fourth straight month of double-digit stock price growth for Google.

• Equity markets in foreign developed countries (Europe, Japan, United Kingdom) had a similarly quiet month. This region’s year-to-date outperformance relative to United States Large Cap Equities came largely from February – May of this year, as the US dollar went through one of its weakest periods in decades, boosting performance for US investors in foreign markets. Through the end of November, approximately 40% of the year-to-date return for US investors in the MSCI EAFE Index has been driven by dollar depreciation. In contrast to US markets, value stocks have strongly outpaced growth stocks abroad year-to-date.

• Americans’ perception of the US economy has communicated a drastically different story than the data. At face value, US GDP growth, unemployment, and inflation are not flashing warnings, but consumer sentiment is communicating a bleaker picture than the 2008 Financial Crisis. The November data for the University of Michigan Index of Consumer Sentiment came in at 50.3—lower than all but one monthly reading since 1978. Americans are disgruntled at the lack of affordability of homes, the cumulative effect of inflation, and the polarizing nature of politics. While investment markets have delivered exceptional performance across the globe for the past decade, the concentration in ownership of assets by the top 1% leaves most Americans disproportionately unaffected by strong markets.

Fixed Income Market Update

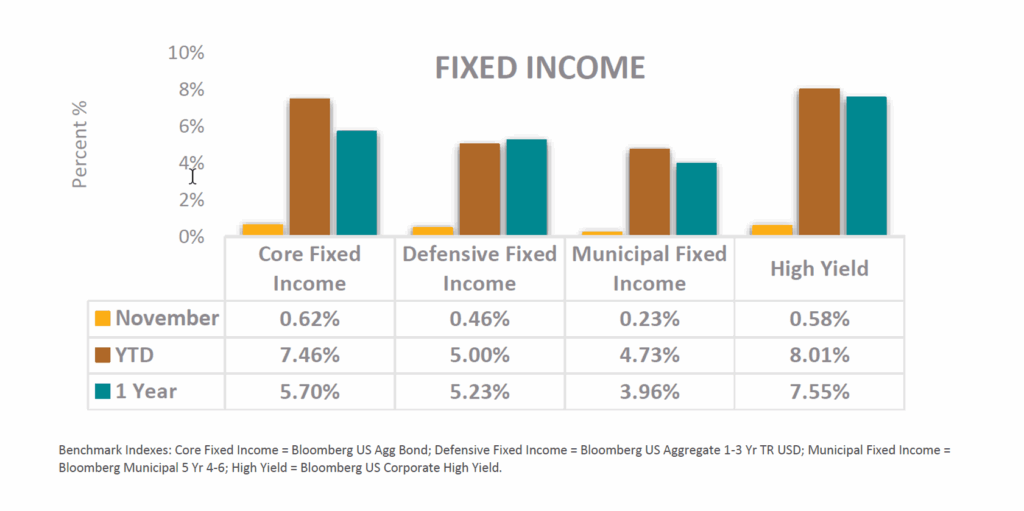

• Core Fixed Income is showing signs of strength after a challenging past 5 years, with November’s modest performance adding to a strong year for the asset class. A modest decline in the yield on US Treasuries provided a boost to performance. In recent news, public debt financing by large technology companies has accelerated as the staggering arms race of investment in AI infrastructure heats up. According to research from JP Morgan, technology capital expenditures (“capex”) as a percentage of US GDP is expected to surpass the Broadband capex from 2000 and the investment made by the US Government in the 1960s for the Interstate Highway System Investment and Apollo Project.

• According to CME Group’s Fedwatch tool, the markets expected further lowering of the target federal funds rate by 0.25% to a target range of 3.50% – 3.75%. The weakness in new job creation in the economy and a manageable level of inflation have left the door open for an additional rate cut in 2025.

• President Trump signed a deal on November 12 to end the longest government shutdown in US history. The shutdown impacted directly the incomes of Federal workers and Americans relying on Federal government programs such as Supplemental Nutrition Assistance Program (SNAP). The shutdown also created delays or outright cancellations in the publication of key data pieces on the US economy. As the Federal Reserve navigates prudent monetary policy, accurate and timely data is critical.

Mission’s market and investment commentaries reflect the analysis, interpretation, and economic views and opinions of our investment team. They are not intended to provide investment advice for any individual situation. Please contact us if we can provide insight and advice for your specific needs.