September 2025 Market Commentary

Market Update and Economic Developments

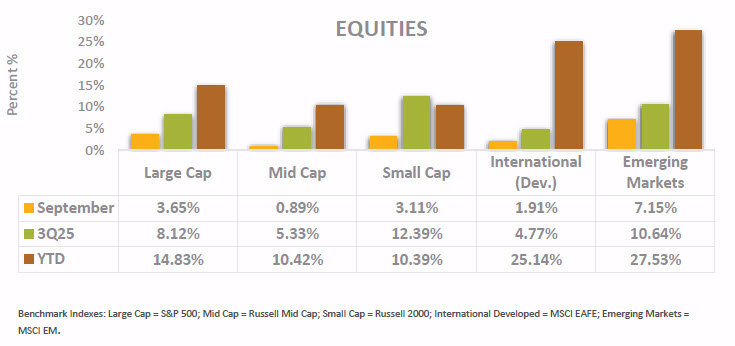

• In September, equities continued moving upward with the S&P 500 reaching a record high eight times in the 30 days and closing with a 3.65% gain on the month. Small companies were not far behind, with the Russell 2000 Index posting 3.22% for the month. Since smaller companies often hold floating rate debt, they receive relatively more benefit from the Federal Reserve’s decision to lower the federal funds rate. Mid-size companies had middling performance this month, returning 0.89% as the index benefited less from the continued earnings growth of the AI hyperscalers and these companies generally have lower levels of floating rate debt.

• International equities have had a stellar three quarters, with developed countries (as measured by the MSCI EAFE Index) returning over 25% for the year, and emerging countries (as measured by the MSCI Emerging Markets Index) returning over 27% in the last nine months, with over seven percent of that growth occurring just in September. A fair portion of this performance can be attributed to the dollar’s devaluation relative to home currencies in these countries. Year-to-date, the value of the dollar has declined by nearly 10% according to the U.S. Dollar DXY Index.

• The estimated statutory tariff rate sits at just over 19% as of the end of September. According to the U.S. Department of the Treasury, $189.6 Billion in customs, duties, and related taxes have been collected so far this year, more than doubling the $72.7 Billion collected at this same time last year. Treasury Secretary Scott Bessent projected that tariff revenue could be “well over half a trillion,” which would make a meaningful impact on the U.S. federal deficit.

Fixed Income Market Update

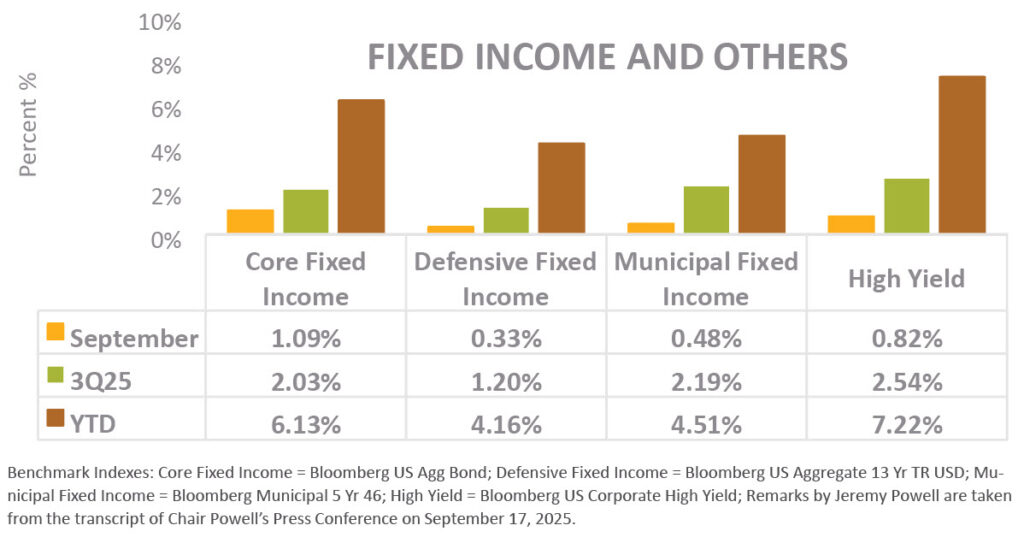

• In September, the Federal Open Markets Committee validated market expectations by lowering the target federal funds rate by ¼ percent to 4.00% – 4.25%. The consumer price index rose by 0.4% in August, which places inflation at 2.9% over the last twelve months. Although this is above the Federal Reserve’s goal of 2%, this rate cut is in response to the labor market. In the words of Federal Reserve Chair Jerome Powell, “With downside risks to employment having increased, the balance of risks has shifted.”

• The unemployment rate has remained below its 50-year average of 6.1%, but it has grown slightly over the last two years and is at 4.3% as of August. Job growth has slowed in recent months, with the U.S. shedding about 32,000 jobs in September according to ADP, a private payroll service provider. However, this lack of supply has been met by a smaller number of jobseekers as overall immigration dropped dramatically over the past few months, dampening the effect of lower job growth on unemployment.

• Core fixed income returned over 1% in September, bringing year-to-date returns to 6.13% as measured by the Bloomberg U.S. Aggregate Bond Index. If the Federal Reserve is entering a cycle of monetary easing, as the market expects, it is likely that short-term fixed income yields will fall. Diversification across durations enables investors to be flexible in responding to market dynamics.

Mission’s market and investment commentaries reflect the analysis, interpretation, and economic views and opinions of our investment team. They are not intended to provide investment advice for any individual situation. Please contact us if we can provide insight and advice for your specific needs.