Many retirees are worried about taking a required minimum distribution (RMD) in a down market and uncertain times. On March 27, 2020, President Trump signed the Coronavirus Aid, Relief, and Economic Security (CARES) Act into law, which alleviates this worry by suspending RMDs for 2020. Congress’s aim in suspending RMDs was to provide relief to [...]

ABOUT OUR COMPANY

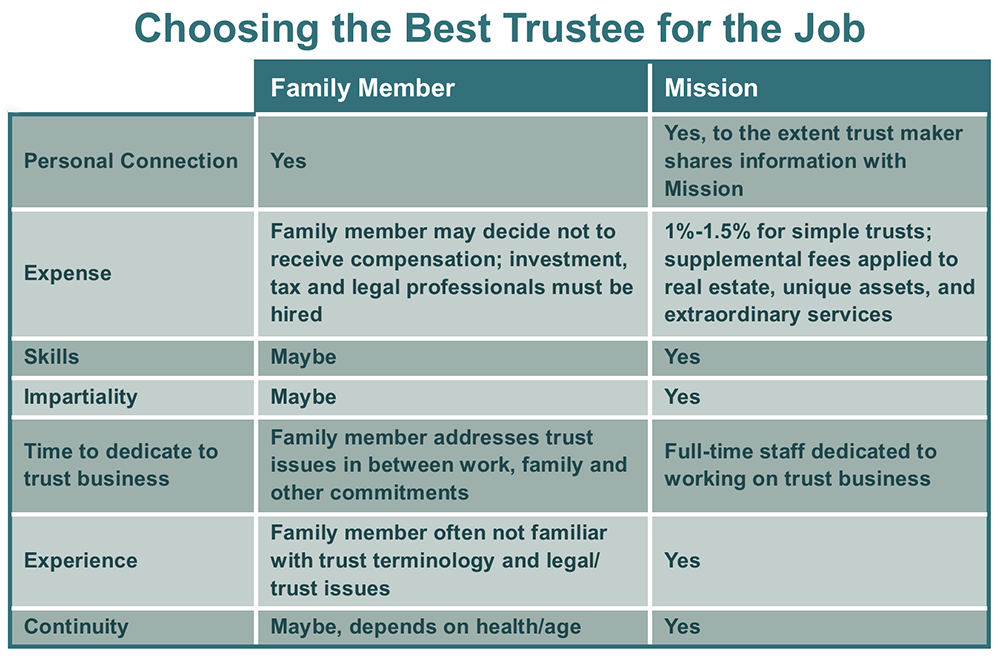

Mission Trust is a business that is all about people. We want to meet with you, get to know you, and be there when you need us—as our three-plus decade history shows. We also want you to get to know us, one of the most stable and experienced trust teams in Arizona. Learn More

Latest News & Insights

3561 East Sunrise Drive, Suite 125, Tucson, Arizona 85718

Tucson: 800-547-1174

4645 N 32nd Street Suite A-100 Phoenix, AZ 85018

Phoenix: (602) 735-0900